IMO 2020: What’s Coming for Ocean Carriers

The International Maritime Organization (IMO) is imposing a new international regulation that is designed to reduce sulfur oxide emissions from carrier ships. The regulation is being implemented to reduce the harmful impact of the shipping industry’s byproduct fuel emissions. The benefits of lower sulfur emissions include improved air quality in port cities and less ocean acidification.

This regulation is scheduled to start on January 1, 2020, and applies to all ships on either international or domestic voyages. The regulation does apply to domestic modes such as truckload or rail. Sulfur content allowed in marine fuels is currently 3.5% but beginning in 2020, the allowed sulfur content will drop to 0.5%.

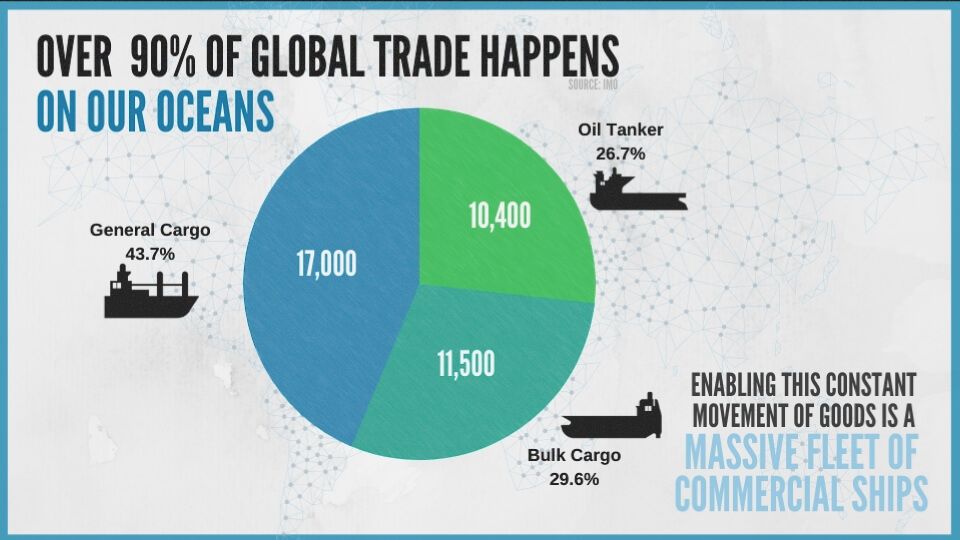

There are approximately 51,000 ships that make up the global fleet and handle 90% of global trade moves. Around 60,000 ships globally produce a high level of pollutants in their bunker exhaust. There is already a high demand for maritime fuel, with a volume of 2.1 billion barrels, or 244 million gallons, traded globally each day. Burning standard bunker fuel accounts for almost 90% of sulfur emission globally. Furthermore, the largest 15 vessels produce more sulfur than the combined total of all of the world’s automobiles.

Carrier Options to Comply with the IMO 2020 Regulation

The IMO regulation aims to reduce sulfur emissions by 80% through two means. The regulation will either require ships to use fuel that is better for the environment or the ships must undergo physical upgrades to accommodate one of two alternate solutions. The three options available are:

- Switch to low-sulfur fuel that is better for the environment

- Implement onboard scrubbers that process the exhaust created by current fuel (physical upgrade)

- Convert fuel supply to liquid natural gas (LNG) (physical upgrade)

The IMO is allowing each carrier to select the option that is best for their fleet, but all three of the options come at a cost. The regulation may cost the industry up to $15 billion in 2020.

- Switching to low-sulfur fuel that is cleaner may also be 25% more expensive than traditional fuels

- Installing scrubbers can cost $3M – $5M per carrier and can take the carrier out of service for 30-60 days, depending on the size of the vessel

- Infrastructures to use liquid natural gas are still in its beginning stages and could cost $25 – $30M per carrier. This option is best suited for new builds.

A possible fourth option is to obtain waivers/non-compliance, in which IMO 2020 provides waivers in situations where compliant fuel is not available. In this case, ship carriers would have to present a record of actions taken in an attempt to achieve compliance.

Lastly, another strategy is slow steaming, which saves on fuel cost and uses up a portion of idle capacity by filling out vessel strings that need more ships due to slower speeds. Slow steaming and super-slow steaming are bound to increase as operating costs rise. These methods will help the impact on cost but likewise will lengthen supply chain lead-times, creating other issues.

IMO 2020 Effects on the Industry

The new IMO regulation has good intentions but has poor timing. Global transportation has gone through months of stress due to the U.S. and China tariff war and this will likely add more layers of tension. Potential effects from IMO 2020 include:

- Freight rates will increase as fuel costs increase

- Longer routes will cost more due to greater fuel consumption

- Possible tighter capacity as weight and density of cargo factor into fuel needs

- Longer transit times may occur if steamships start slow or super-slow steaming

- Higher trucking rates if the cost of diesel surges due to shifting oil market demands

Domestic land transportation will likely be affected because they will face new competition from ships for low-sulfur fuel. This competition may result in a 100% rise in the cost of diesel fuel and disrupt the availability of supply in certain key markets. Blend specs and compatibility remain non-standardized under the new rules, further complicating the issue. Currently, no one knows which types of fuels will be available at what price, specification, or in what quantity. These factors will only contribute to a large scale disruption.

As a byproduct of fuel costs increasing, global transportation costs will also increase. The price of fuel for ocean carriers could go up an estimated 20-50%, which will be made up for in costs to consumers. Added costs will cascade across global supply chains, adding nearly $40 billion in increased shipping costs. The overall impact of consumers in 2020 could be as much as $240 billion.

How to Prepare for IMO 2020 with R+L Global Logistics

R+L Global Logistics provides a wide variety of ocean importing and exporting options to assist with your shipping needs. Our ocean services include LCL (less than container load) and FCL (full container load), plus fully integrated transport, clearance, and distribution through our warehousing and fulfillment network.

One way to decrease disruptions throughout your ocean transportation needs is to ship early, in order to avoid capacity shortage, and arrange for domestic storage, if needed. You can also consider air freight for certain shipments as a replacement for ocean shipments. Our air freight shipping options include:

- Guaranteed Next-Flight-Out

- Priority

- Standard/General

- Economy

- Air Charter Services

- Same-day pickup and processing

Our team of experienced professionals can help you find the most cost-efficient and timely method of transportation for your goods. Talk to one of our experienced international shipping experts at 877-510-9133 today to handle your ocean freight, air freight, or international shipping needs.